Senior Congress leader Kapil Sibal whose attempt to establish an ‘independent’ news channel with Tiranga TV failed miserably, recently raised apprehensions over the ‘independence’ of NDTV after Adani Group’s media arm announced it is purchasing a 29.18 per cent stake in the media group.

Taking to Twitter, Sibal expressed concern over Adani’s acquisition of NDTV. “Almost the last bastion of Independent journalism being taken over by industry,” said Sibal, who despite being a senior leader of the Congress party, had felt no compunction in backing news channel Tiranga TV, widely believed to have launched as a propaganda arm of the party ahead of the 2019 general elections.

Unfortunately for Sibal, Tiranga TV did not hit off and was shut down, curiously after the 2019 general elections and months after protests from employees who accused the company of abruptly sacking them.

Nevertheless, the Congress leader’s argument that if someone who invests money in a media organisation is a criterion for wielding control over the company, then none of the private media outfits in the country could be termed as independent, including NDTV, before the announcement of the Adani acquisition as the organisation was then owned and controlled by the Roys, who are known to have close links to the senior Congress leaders.

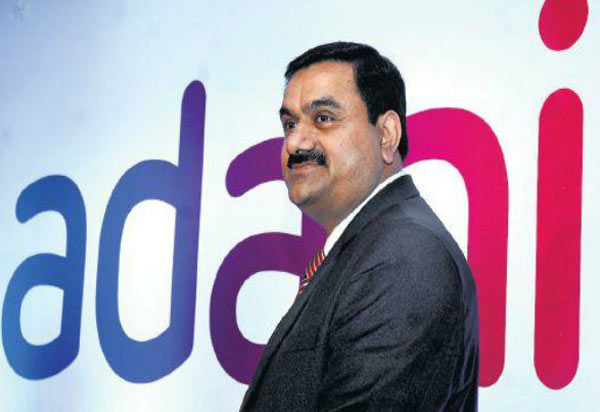

Sibal’s handwringing over the ownership and the ‘independence’ of NDTV comes a day after the Adani Group’s media arm, AMG Media Network Ltd (AMNL) released a statement on Tuesday, providing details of its offer to indirectly acquire NDTV and launch an Open Offer.

Adani Group to acquire a 29.18 per cent stake in NDTV, launches an open offer to acquire another 26 per cent

The acquisition of a 29.18 per cent stake will be indirect and made through Vishvapradhan Commercial Pvt Ltd (VCPL), a wholly owned subsidiary of AMG Media Network Ltd (AMNL), which is owned by Adani Enterprises Ltd (AEL).

“AMNL’s wholly owned subsidiary VCPL holds warrants of RRPR Holding Private Limited (RRPR) entitling it to convert them into a 99.99% stake in RRPR. VCPL has exercised warrants to acquire a 99.5% stake in RRPR. Such acquisition will result in VCPL acquiring control of RRPR,” the media release said.

This will trigger an open offer to acquire up to a 26 per cent stake in NDTV in terms of SEBI’s takeover regulations, the organisation said.

Following the Adani Group’s announcement, NDTV said the conglomerate did not consult before exercising its right to convert the loan into equity. NDTV’s statement that no discussions of acquisition took place, coupled with remarks made by people like Kapil Sibal and other social media users, has tried to lend an air of illegitimacy to the entire affair. It is, therefore, imperative to discuss how NDTV got its money and how the Adani Group holds the legal right to purchase the stake in the media group.

How Roys, the promoters of NDTV, took one loan to pay off another loan and got the organisation entangled in a debt trap

Prannoy Roy (PR) and Radhika Roy (RR) own and control RRPR Holding Pvt. Ltd., the promoter group company of NDTV, holding 61.45 per cent of the total shareholding of the organisation.

While the monetary troubles of NDTV began in 2004, their first shenanigan was their deal with General Atlantic Partners Investment (GA). That deal allegedly violated PIT (Prohibition of Insider Trading Regulations) and SAST (Substantial Acquisition of Shares & Takeover Regulations) of the Securities and Exchange Board of India (SEBI). The details of that deal have been covered in detail by PGurus and can be read here.

In June 2008, the promoters of NDTV made an open offer for the shares of the company. To bankroll the open offer, they took a loan of Rs 540 crores from Indiabulls Financial Services Ltd by pledging their shares in NDTV as security.

Four months later, in October 2008, NDTV promoters borrowed Rs 375 crores from the ICICI Bank Ltd at 19 per cent per annum to repay their loan obtained from Indiabulls Financial Services. To obtain the borrowing of Rs 375 crores, the promoters had encumbered their entire shareholding in NDTV through non-disposal undertakings with ICICI Bank, meaning although the shares of NDTV were owned by the promoters, they are at the same time subject to a legal claim by the ICICI Bank.

A few months later, in July 2009, NDTV promoters took another loan of Rs 350 crores from VCPL to repay ICICI Bank Ltd. RRPR, Dr Roy, Ms Roy and VCPL were signatories to the loan agreement. Through the agreement, RRPR Holding company secured Rs 350 crores which enabled it to discharge its liability towards ICICI Bank.

At the same time, two call option agreements dated 21 July 2009 were executed for 1,63,05,404 equity shares of NDTV, which represents 26% of its shares. One of the call option agreements was executed between RRPR Holding and Shyam Equities Pvt Ltd (SEPL) in terms of which SEPL had the right to buy 11.01% equity shares of NDTV from the promoter company at a call option price of Rs 214.65 per share.

Similarly, another call options agreement was executed between RRPR Holding and Subhgami Trading Pvt Ltd (STPL), in terms of which STPL had a right to purchase 14.99% equity shares of NDTV from RRPR Holding at a call option price of Rs 214.65 per share. Both SEPL and STPL are associates of Vishvapradhan Commercial Pvt Ltd (VCPL), a wholly owned subsidiary of AMG Media Network Ltd (AMNL), which is owned by Adani Enterprises Ltd (AEL). Another loan for Rs53.85 crore was taken by NDTV promoters from VCPL on 25 January 2010.

SEBI finds a violation by NDTV over its non-disclosure of the loan agreement with VCPL, a subsidiary wholly owned by Adani’s AMG Media Network Ltd

The two call agreements were challenged by the Securities Exchange Board of India (SEBI) and they levied penalties against the promoters and NDTV for its failure to disclose information about the loan agreement with VCPL.

The Securities Appellate Tribunal (SAT) upheld SEBI’s finding of violation committed by NDTV and its promoters but reduced the financial penalties on promoters in the case related to non-disclosure of the loan agreement to Rs 5 crores from Rs 25 crores. Further, the appellate tribunal also slashed the fine levied on NDTV to Rs 10 lakhs from Rs 5 crores.

According to legal analysts, the control of RRPR went away from the Roys to the Adani Group after the warrants were executed, indicating that the loans continued to remain unpaid.

More importantly, the agreements were never challenged by the NDTV, Roys or anyone who had information about it, demonstrating that they were intimately aware of the implications of the agreements should they fail to foot the loan.

VCPL and its link to the Reliance Group

Vishvapradhan Commercial Private Limited (VCPL), is company incorporated in 2008. In 2009, it offered unsecured loan to NDTV’s holding company, Radhika Roy Prannoy Roy Holding Private Limited (RRPRH) worth Rs 403.85 crore. RRPRH held 29% equity in NDTV.

VCPL, in same year, had received unsecured loan from Shinano Retail Private Limited, which had obtained money from Reliance Industrial Investments and Holdings Limited, a part of Reliance Group. Shinano Retail was a fully owned subsidiary of Reliance Group. Since these documents are publicly available, NDTV was aware that it was obtaining unsecured loan from an entity that was linked to Reliance group. For its part, VCPL was owned by Shinano Retail and Teesta Retail Private Limited, another fully owned subsidiary of Reliance Group.

Niira Radia link: Infamous lobbyist had claimed she and Mukesh Ambani’s trusted aide would meet Prannoy Roy and support him

It is also worth noting that infamous lobbyist Niira Radia, who shot into the limelight after her explosive tapes with many public figures, including politicians, journalists and business houses, had gone public, spoke with MK Venu about meeting Prannoy Roy along with Manoj Modi, the trusted aide of RIL chairman Mukesh Ambani. In the conversation, Radia says that she and Manoj will be meeting Prannoy Roy who needed their “support.”

NDTV’s claim of lack of consent a fig leaf intended to cover its association with Reliance, Adani

Taken together, NDTV’s claims that they had not been consulted or their opinion was not sought before the Adani Group moved to acquire a stake in it is a dead giveaway that the media group was intimately aware that such a scenario was not entirely outside of the realm of possibility.

Its business interest with Reliance-owned subsidiary, agreeing to terms of loans that could grant the borrower the right to convert the debt into equity underscores that the company was aware with whom it was dealing with and of the implications the non-payment of loans could borne.